Triangle BreakDown Technical Pattern

Learn about the Triangle Bearish Breakout pattern in stock trading - a continuation pattern that signals potential downward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Triangle BreakDown Patterns

15 patterns found

Kardan Real Estate Enterprise and Development Ltd

IL

Market Cap: 360.82M

Industry: Real Estate Services

Triangle BreakDown

12/14/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

TuanChe Limited

CN

Market Cap: 1.92M

Industry: Werbungsagentur

Triangle BreakDown

12/11/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Immsi S.p.A

IT

Market Cap: 212.86M

Industry: Auto Manufacturers

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

United Electronics Company

SA

Market Cap: 1.78B

Industry: Specialty Retail

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Trugolf Inc

US

Market Cap: 1.64M

Industry: Leisure

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Deswell Industries Inc

MO

Market Cap: 56.68M

Industry: Electronic Components

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Aegon NV

NL

Market Cap: 12.33B

Industry: Insurance - Diversified

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Dropbox Inc

US

Market Cap: 7.35B

Industry: Software - Infrastructure

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

LumenRadio AB

SE

Market Cap: 73.11M

Industry: Communication Equipment

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

JET2 PLC

US

Market Cap: 60.85M

Industry: Oil & Gas Equipment & Services

Triangle BreakDown

12/10/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Brenmiller Energy Ltd

IL

Market Cap: 4.44M

Industry: Utilities - Renewable

Triangle BreakDown

12/9/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

AA Mission Acquisition Corp.

US

Market Cap: 367.08M

Industry: Shell Companies

Triangle BreakDown

12/9/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

EUDA Health Holdings Limited

SG

Market Cap: 102.73M

Industry: Real Estate Services

Triangle BreakDown

12/9/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Blink Charging Co

US

Market Cap: 137.48M

Industry: Engineering & Construction

Triangle BreakDown

12/8/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

EUDA Health Holdings Limited

SG

Market Cap: 102.73M

Industry: Real Estate Services

Triangle BreakDown

12/5/2025

Continuation pattern with converging trendlines, breaking downward to signal potential bearish momentum

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Triangle BreakDown Patterns

Triangle BreakDown patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Triangle Bearish Breakout in Stocks

What is the Triangle Bearish Breakout Pattern in Stocks?

The Triangle Bearish Breakout pattern is a continuation pattern that appears during a downtrend, indicating a potential continuation of the downward movement. This pattern forms when the price of a stock consolidates within converging trendlines, creating a triangular shape, before breaking out to the downside. In stock trading, the Triangle Bearish Breakout pattern is significant because it often signals the continuation of a bearish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Triangle Bearish Breakout Patterns

Identifying the Triangle Bearish Breakout pattern involves several key steps:

- Downtrend: Look for a clear downtrend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout: The price breaks below the lower trendline, confirming the pattern.

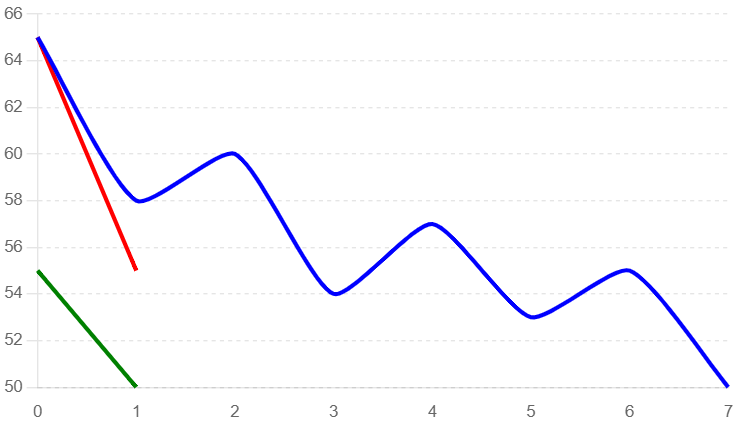

Identifying a Triangle Bearish Breakout Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Triangle Bearish Breakout pattern. Key elements to observe include the downtrend, the consolidation phase, and the subsequent breakout.

- Downtrend: The price of the stock shows a clear downward trend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout Confirmation: The price breaks below the lower trendline, confirming the pattern.

Triangle Bearish Breakout Pattern

Key Indicators

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong selling interest.

- Trendlines: Converging trendlines forming the triangle.

- Candlestick Patterns: Look for bearish candlestick patterns near the breakout point.

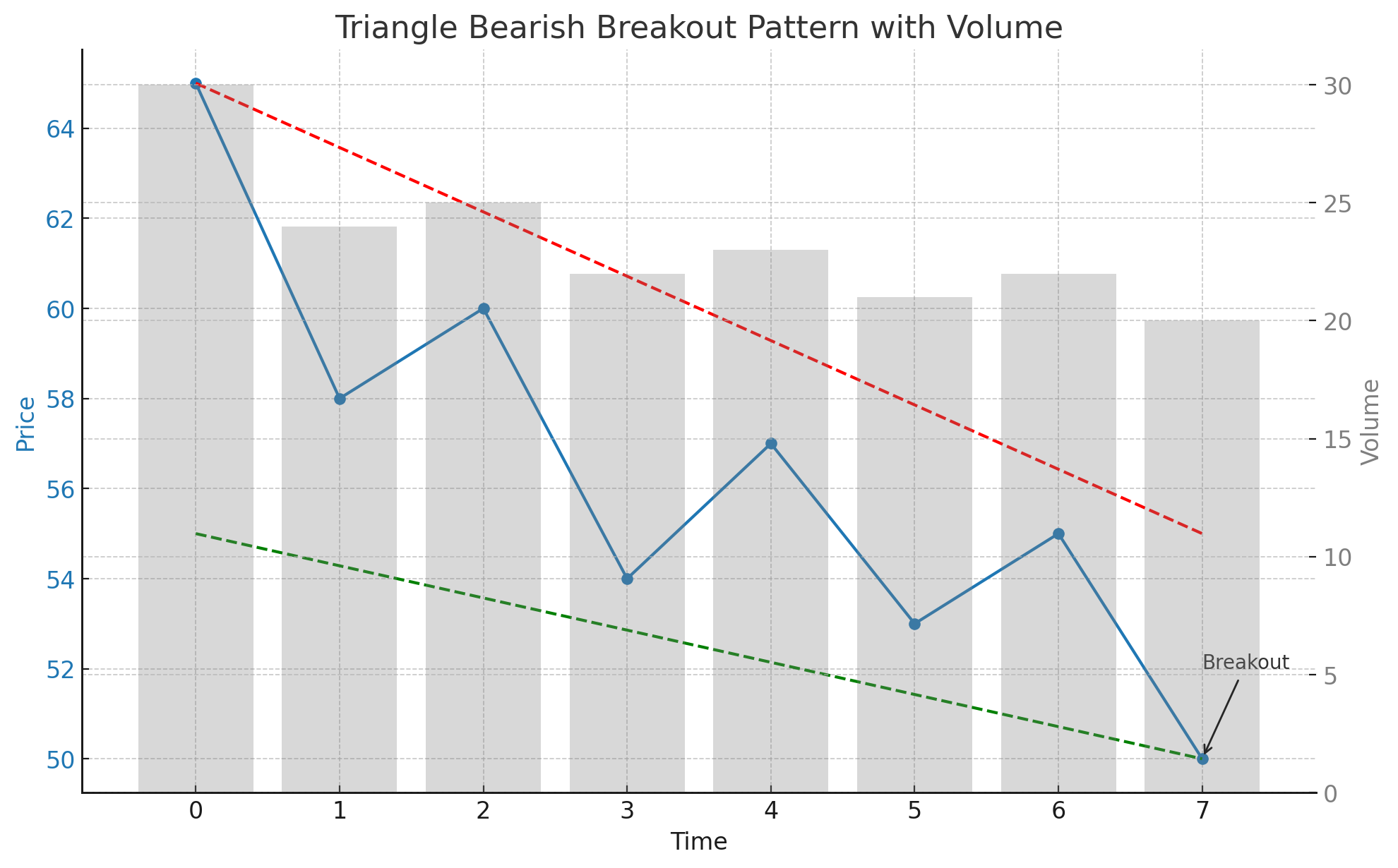

Triangle Bearish Breakout Pattern with Volume Analysis

This example highlights the role of volume in confirming the Triangle Bearish Breakout pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Downtrend: The price trend is downward, characterized by decreasing prices and moderate volume.

- Consolidation: The price consolidates within converging trendlines with moderate volume.

- Breakout: The price breaks below the lower trendline with a significant spike in volume, confirming the pattern.

Triangle Bearish Breakout Pattern with Volume

Frequently Asked Questions

What is the Triangle Bearish Breakout pattern in stock trading?

The Triangle Bearish Breakout pattern in stock trading is a continuation pattern that appears during a downtrend. It indicates a potential continuation of the downward movement and is characterized by the price consolidating within converging trendlines before breaking out to the downside.

How reliable is the Triangle Bearish Breakout pattern in stocks?

The Triangle Bearish Breakout pattern is considered a reliable bearish continuation signal in stock trading, especially when confirmed by increased trading volume and a strong breakout below the lower trendline. However, it should be used alongside other technical analysis tools.

Can the Triangle Bearish Breakout pattern appear in any stock?

Yes, the Triangle Bearish Breakout pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Triangle Bearish Breakout pattern?

Common mistakes include entering the trade too early before the breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Triangle Bearish Breakout pattern, traders can better anticipate bearish continuations and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Triangle Bearish Breakout pattern in stocks?

Key indicators include identifying significant trendlines, confirming the pattern with increased volume during the breakout, and observing bearish candlestick patterns near the breakout point. These indicators help validate the Triangle Bearish Breakout pattern and provide insights for potential significant price movements.