Multiple Top Technical Pattern

Learn about the Multiple Top pattern in stock trading - a bearish reversal pattern that signals potential downward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Multiple Top Patterns

15 patterns found

Heartland Express Inc

US

Market Cap: 726.62M

Industry: Trucking

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Rush Enterprises Inc

US

Market Cap: 4.23B

Industry: Auto & Truck Dealerships

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

East Pipes Integrated Company for Industry

SA

Market Cap: 1.22B

Industry: Steel

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Sam-A Aluminium Co. Ltd.

KR

Market Cap: 240.53M

Industry: Aluminum

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Fulton Financial Corp

US

Market Cap: 3.43B

Industry: Banks - Regional

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Cactus Inc

US

Market Cap: 3.25B

Industry: Oil & Gas Equipment & Services

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Wallenius Wilhelmsen ASA

NO

Market Cap: 4.29B

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Myungmoon Pharmaceutical Co. Ltd.

KR

Market Cap: 38.13M

Industry: Drug Manufacturers - Specialty & Generic

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Trustmark Corp

US

Market Cap: 2.48B

Industry: Regionale Banken

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Heritage Financial Corp

US

Market Cap: 819.71M

Industry: Banks - Regional

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Colony Bankcorp Inc

US

Market Cap: 319.58M

Industry: Banks - Regional

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Old National Bancorp

US

Market Cap: 8.71B

Industry: Banks - Regional

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Biodyne Co. Ltd.

KR

Market Cap: 311.64M

Industry: Medical Instruments & Supplies

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Profound Medical Corp

CA

Market Cap: 199.28M

Industry: Medical Devices

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

1st Source Corp

US

Market Cap: 1.61B

Industry: Banks - Regional

Multiple Top

12/11/2025

Bearish pattern with three or more peaks at similar price levels, indicating strong resistance

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Multiple Top Patterns

Multiple Top patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Multiple Top in Stocks

What is the Multiple Top Pattern in Stocks?

The Multiple Top pattern is a bearish reversal pattern that appears at the end of an uptrend, indicating a potential downward movement. This pattern forms when the price of a stock hits a high multiple times before declining. It resembles the shape of several "M" formations on a price chart. In stock trading, the Multiple Top pattern is significant because it often marks the end of a bullish phase and the beginning of a bearish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Multiple Top Patterns

Identifying the Multiple Top pattern involves several key steps:

- Initial Uptrend: Look for a clear uptrend where the price reaches new highs.

- Multiple Tops: Observe the price hitting high points multiple times and declining to form lows.

- Confirmation: After the last top, the price should decline and break below the lows formed between the tops, confirming the pattern.

Identifying a Multiple Top Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Multiple Top pattern. Key elements to observe include the initial uptrend, the formation of the multiple tops, and the subsequent breakout.

- Initial Uptrend: The price of the stock shows a clear uptrend, indicating bullish market sentiment.

- Multiple Tops: The price hits high points (Points A, B, C, etc.) and then declines to form lows.

- Breakout Confirmation: After the final top, the price declines and breaks below the lows formed between the tops, confirming the pattern.

Multiple Top Pattern

Key Indicators

- Candlestick Patterns: Look for reversal candlestick patterns near the tops.

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong selling interest.

- Resistance Levels: The tops should align with significant resistance levels on the chart.

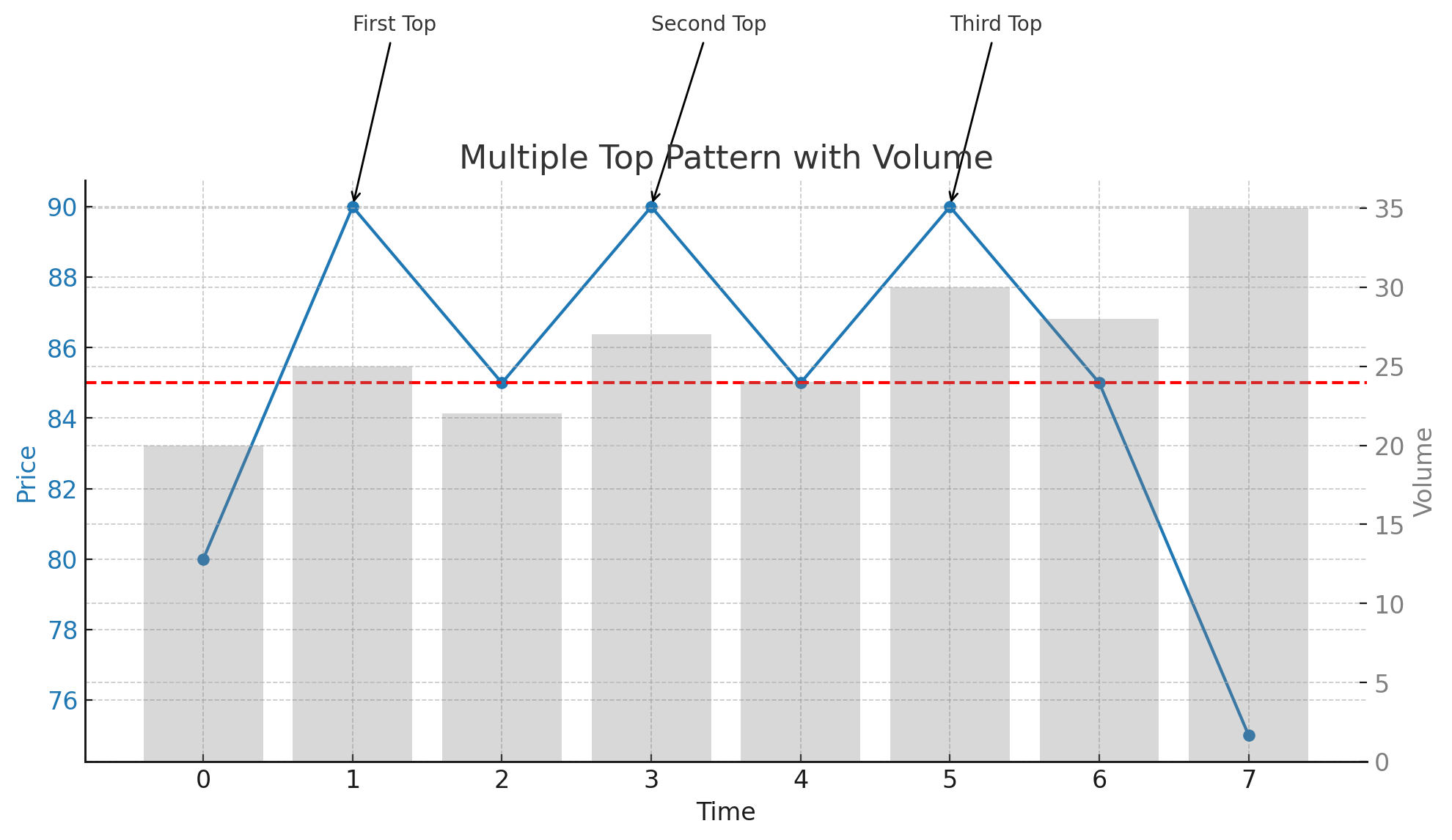

Multiple Top Pattern with Volume Analysis

This example highlights the role of volume in confirming the Multiple Top pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Initial Uptrend: The price trend is upward, characterized by increasing prices and moderate volume.

- Multiple Tops: The price reaches high points with moderate volume as sellers begin to enter the market.

- Rebound to Lows: The price declines from each top, but volume remains moderate.

- Breakout Confirmation: The price declines and breaks below the lows formed between the tops, accompanied by a significant spike in volume, confirming the pattern.

Multiple Top Pattern with Volume

Frequently Asked Questions

What is the Multiple Top pattern in stock trading?

The Multiple Top pattern in stock trading is a bearish reversal pattern that appears at the end of an uptrend. It indicates a potential downward movement and is characterized by the price hitting a high point multiple times before declining.

How reliable is the Multiple Top pattern in stocks?

The Multiple Top pattern is considered a reliable bearish reversal signal in stock trading, especially when confirmed by increased trading volume and a strong breakout below the lows formed between the tops. However, it should be used alongside other technical analysis tools.

Can the Multiple Top pattern appear in any stock?

Yes, the Multiple Top pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Multiple Top pattern?

Common mistakes include entering the trade too early before the breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Multiple Top pattern, traders can better anticipate bearish reversals and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Multiple Top pattern in stocks?

Key indicators include identifying significant resistance levels, confirming the pattern with increased volume during the breakout, and observing reversal candlestick patterns near the tops. These indicators help validate the Multiple Top pattern and provide insights for potential significant price movements.