Head & Shoulders Technical Pattern

Learn about the Bullish Head-and-Shoulders pattern in stock trading - a reversal pattern that signals potential upward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Head & Shoulders Patterns

15 patterns found

Netanel Group Ltd

IL

Market Cap: 113.22M

Industry: Real Estate Services

Head & Shoulders

12/14/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Intelligent Protection Management Corp.

US

Market Cap: 24.47M

Industry: Software - Application

Head & Shoulders

12/12/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Nick Scali Ltd

AU

Market Cap: 1.23B

Industry: Specialty Retail

Head & Shoulders

12/12/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

TH International Limited

CN

Market Cap: 85.79M

Industry: Restaurants

Head & Shoulders

12/12/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Datadog Inc

US

Market Cap: 53.10B

Industry: Software - Application

Head & Shoulders

12/12/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Dongwon Industries Co. Ltd.

KR

Market Cap: 1.28B

Industry: Food Distribution

Head & Shoulders

12/10/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Anebulo Pharmaceuticals Inc

US

Market Cap: 92.85M

Industry: Biotechnology

Head & Shoulders

12/10/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Daelim Trading Co. Ltd.

KR

Market Cap: 24.50M

Industry: Household & Personal Products

Head & Shoulders

12/9/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

3R Games S.A.

PL

Market Cap: 44.43M

Industry: Software & IT Services

Head & Shoulders

12/9/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

RSL Electronics Ltd

IL

Market Cap: 1.56B

Industry: Aerospace & Defense

Head & Shoulders

12/9/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

CytoMed Therapeutics Limited

SG

Market Cap: 21.85M

Industry: Biotechnology

Head & Shoulders

12/9/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Inter & Co, Inc.

BR

Market Cap: 3.63B

Industry: Banks - Regional

Head & Shoulders

12/8/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

CVR Energy Inc

US

Market Cap: 3.28B

Industry: Oil & Gas Refining & Marketing

Head & Shoulders

12/8/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

EcoGraf Ltd

AU

Market Cap: 130.11M

Industry: Other Industrial Metals & Mining

Head & Shoulders

12/8/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

PBF Energy Inc

US

Market Cap: 3.87B

Industry: Oil & Gas Refining & Marketing

Head & Shoulders

12/8/2025

Bearish reversal pattern with three peaks, the middle being highest, often signaling a trend change from bullish to bearish

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Head & Shoulders Patterns

Head & Shoulders patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

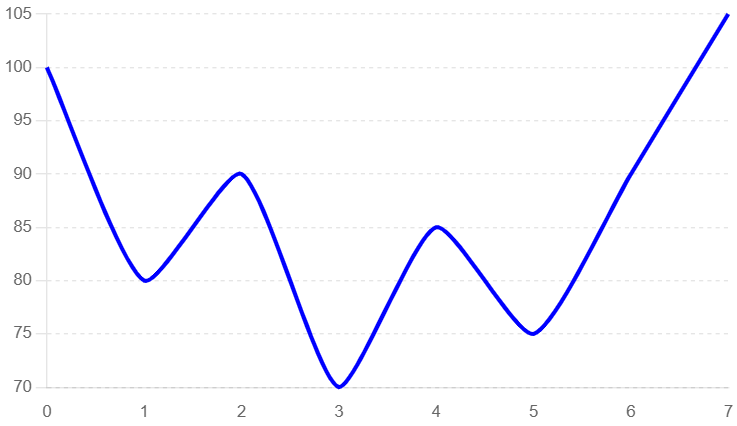

Understanding the Bullish Head-and-Shoulders in Stocks

What is the Bullish Head-and-Shoulders Pattern in Stocks?

The Bullish Head-and-Shoulders pattern is a reversal pattern that appears at the end of a downtrend, indicating a potential upward movement. This pattern forms when the price of a stock creates three successive troughs, with the middle trough (head) being the lowest, flanked by two higher troughs (shoulders). In stock trading, the Bullish Head-and-Shoulders pattern is significant because it often marks the end of a bearish phase and the beginning of a bullish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Bullish Head-and-Shoulders Patterns

Identifying the Bullish Head-and-Shoulders pattern involves several key steps:

- Initial Downtrend: Look for a clear downtrend where the price reaches new lows.

- Left Shoulder: The price hits a low point, rises, and then falls again.

- Head: The price forms a lower low than the left shoulder and rises again.

- Right Shoulder: The price forms a higher low, similar to the left shoulder, and then rises.

- Neckline Breakout: The price breaks above the neckline, confirming the pattern.

Identifying a Bullish Head-and-Shoulders Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Bullish Head-and-Shoulders pattern. Key elements to observe include the initial downtrend, the formation of the left shoulder, head, and right shoulder, and the subsequent breakout.

- Initial Downtrend: The price of the stock shows a clear downtrend, indicating bearish market sentiment.

- Left Shoulder: The price hits a low point and then rises.

- Head: The price forms a lower low and then rises.

- Right Shoulder: The price forms a higher low, similar to the left shoulder, and then rises.

- Breakout Confirmation: The price breaks above the neckline, confirming the pattern.

Bullish Head-and-Shoulders Pattern

Key Indicators

- Candlestick Patterns: Look for reversal candlestick patterns near the shoulders.

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong buying interest.

- Support Levels: The shoulders should align with significant support levels on the chart.

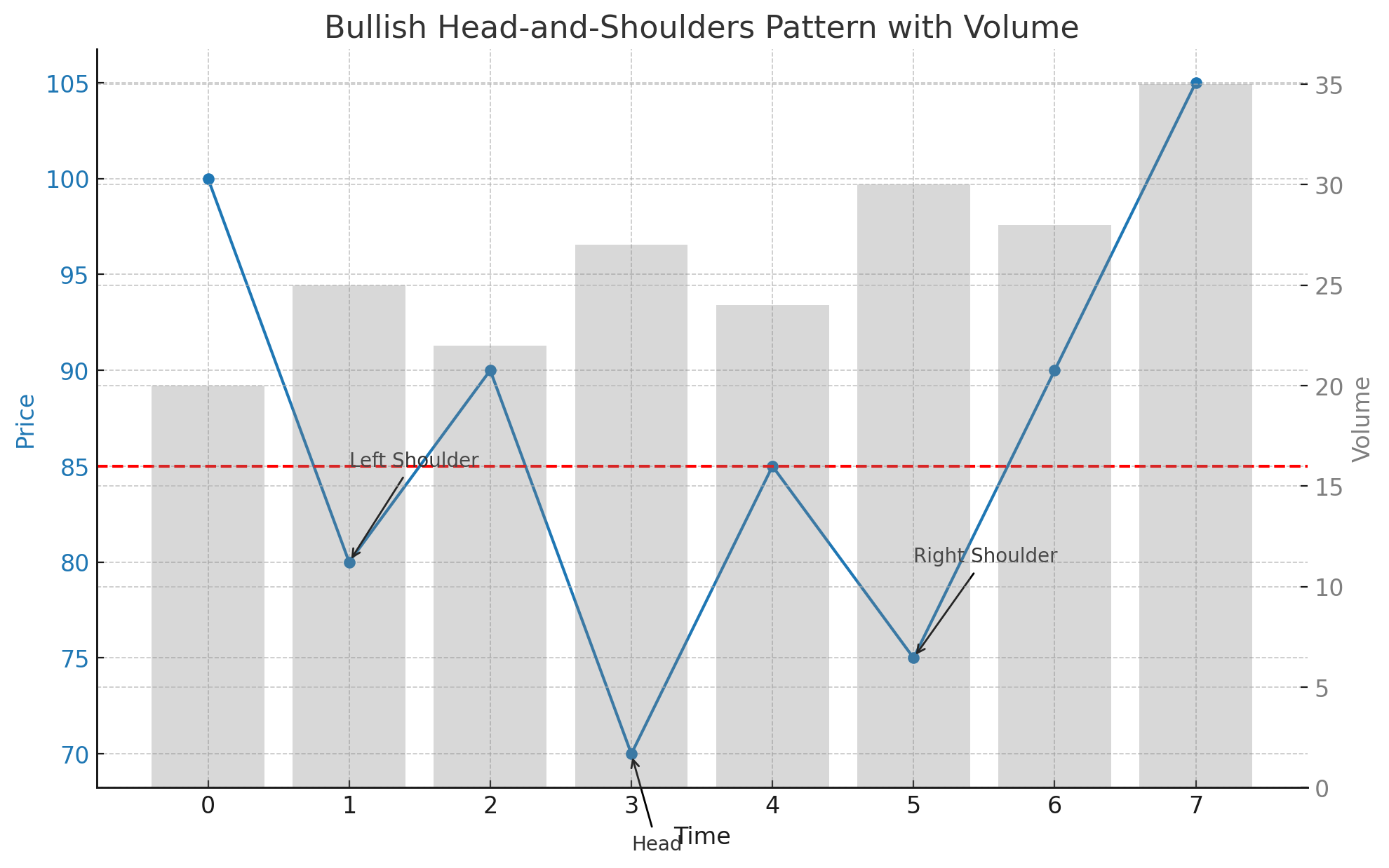

Bullish Head-and-Shoulders Pattern with Volume Analysis

This example highlights the role of volume in confirming the Bullish Head-and-Shoulders pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Initial Downtrend: The price trend is downward, characterized by decreasing prices and moderate volume.

- Left Shoulder: The price hits a low point with moderate volume as buyers begin to enter the market.

- Head: The price forms a lower low with moderate volume and then rises.

- Right Shoulder: The price forms a higher low with moderate volume and then rises.

- Breakout: The price breaks above the neckline with a significant spike in volume, confirming the pattern.

Bullish Head-and-Shoulders Pattern with Volume

Frequently Asked Questions

What is the Bullish Head-and-Shoulders pattern in stock trading?

The Bullish Head-and-Shoulders pattern in stock trading is a reversal pattern that appears at the end of a downtrend. It indicates a potential upward movement and is characterized by the price forming three successive troughs, with the middle trough being the lowest, flanked by two higher troughs.

How reliable is the Bullish Head-and-Shoulders pattern in stocks?

The Bullish Head-and-Shoulders pattern is considered a reliable bullish reversal signal in stock trading, especially when confirmed by increased trading volume and a strong breakout above the neckline. However, it should be used alongside other technical analysis tools.

Can the Bullish Head-and-Shoulders pattern appear in any stock?

Yes, the Bullish Head-and-Shoulders pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Bullish Head-and-Shoulders pattern?

Common mistakes include entering the trade too early before the neckline breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Bullish Head-and-Shoulders pattern, traders can better anticipate bullish reversals and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Bullish Head-and-Shoulders pattern in stocks?

Key indicators include identifying significant support levels, confirming the pattern with increased volume during the breakout, and observing reversal candlestick patterns near the shoulders. These indicators help validate the Bullish Head-and-Shoulders pattern and provide insights for potential significant price movements.