Golden Cross Technical Pattern

Learn about the Golden Cross pattern in stock trading - a bullish reversal pattern that occurs when short-term moving average crosses above long-term moving average. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Golden Cross Patterns

15 patterns found

Prudential PLC

US

Market Cap: 41.32B

Industry: Insurance - Life

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Schlumberger NV

US

Market Cap: 57.46B

Industry: Oil & Gas Equipment & Services

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

YPF Sociedad Anónima

AR

Market Cap: 13.82B

Industry: Oil & Gas Integrated

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

MediciNova Inc

US

Market Cap: 76.51M

Industry: Biotechnology

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Portman Ridge Finance Corp

US

Market Cap: 172.68M

Industry: Asset Management

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

4Imprint Group Plc

GB

Market Cap: 1.46B

Industry: Advertising Agencies

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Banco Macro S.A

AR

Market Cap: 5.51B

Industry: Banks - Regional

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Haemonetics Corp

US

Market Cap: 4.03B

Industry: Medical Devices

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Krispy Kreme Inc

US

Market Cap: 734.88M

Industry: Grocery Stores

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Capricor Therapeutics Inc

US

Market Cap: 1.23B

Industry: Biotechnologie

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Tandem Diabetes Care Inc

US

Market Cap: 1.42B

Industry: Medical Devices

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

INNOX Advanced Materials Co. Ltd.

KR

Market Cap: 165.67M

Industry: Semiconductor Equipment & Materials

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

IRSA Inversiones Y Representaciones

AR

Market Cap: 1.17B

Industry: Real Estate Services

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Harmonychain AS

NO

Market Cap: 43.99M

Industry: None

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

8X8 INC

US

Market Cap: 281.44M

Industry: Software - Application

Golden Cross

12/12/2025

Bullish pattern with short term moving average (50) closing above the long term m.a. (200), indicating potential upward momentum

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Golden Cross Patterns

Golden Cross patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Golden Cross in Stocks

What is the Golden Cross Pattern in Stocks?

The Golden Cross pattern is a bullish reversal pattern that occurs when a short-term moving average crosses above a long-term moving average. This pattern signifies a potential upward movement in stock prices and is considered a strong signal of a bullish trend. In stock trading, the Golden Cross pattern is significant because it often marks the transition from a bearish phase to a bullish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Golden Cross Patterns

Identifying the Golden Cross pattern involves several key steps:

- Downtrend: Look for a clear downtrend in the stock's price.

- Short-Term Moving Average: The short-term moving average (e.g., 50-day MA) crosses above the long-term moving average (e.g., 200-day MA).

- Confirmation: The crossover should be accompanied by increased trading volume, confirming the pattern.

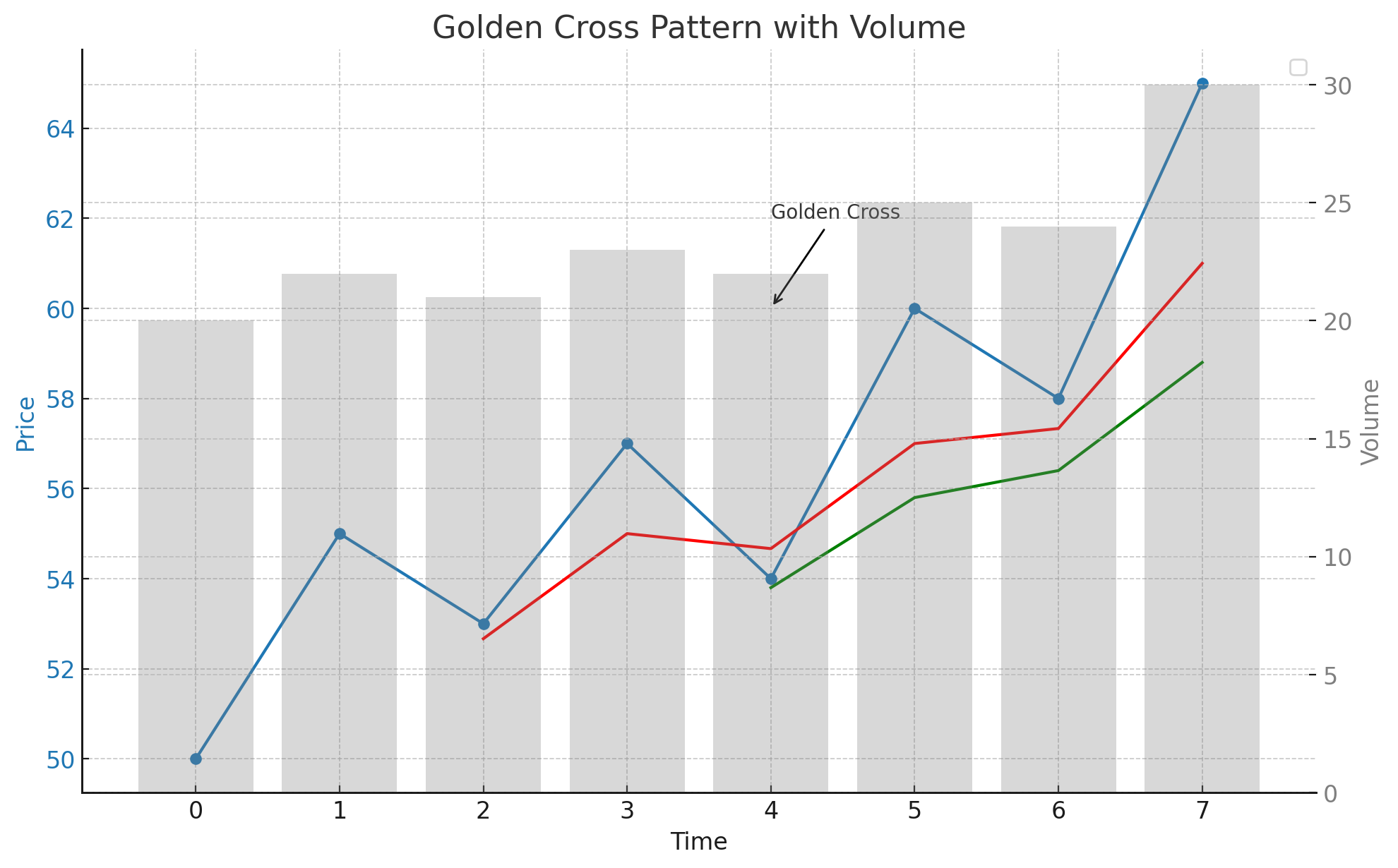

Identifying a Golden Cross Pattern

In this example, we use a typical stock chart to illustrate the formation of a Golden Cross pattern. Key elements to observe include the downtrend, the crossover of moving averages, and the subsequent increase in stock price.

- Downtrend: The price of the stock shows a clear downward trend leading into the pattern.

- Crossover: The short-term moving average crosses above the long-term moving average.

- Breakout Confirmation: The price rises after the crossover, confirming the pattern.

Golden Cross Pattern

Key Indicators

- Moving Averages: The short-term moving average crossing above the long-term moving average.

- Volume Spikes: Increased trading volume often accompanies the crossover, indicating strong buying interest.

- Support Levels: The crossover should occur near significant support levels on the chart.

Golden Cross Pattern with Volume Analysis

This example highlights the role of volume in confirming the Golden Cross pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Downtrend: The price trend is downward, characterized by decreasing prices and moderate volume.

- Crossover: The short-term moving average crosses above the long-term moving average with moderate volume.

- Breakout: The price rises after the crossover with a significant spike in volume, confirming the pattern.

Golden Cross Pattern with Volume

Frequently Asked Questions

What is the Golden Cross pattern in stock trading?

The Golden Cross pattern in stock trading is a bullish reversal pattern that occurs when a short-term moving average crosses above a long-term moving average. It signifies a potential upward movement in stock prices and is considered a strong signal of a bullish trend.

How reliable is the Golden Cross pattern in stocks?

The Golden Cross pattern is considered a reliable bullish reversal signal in stock trading, especially when confirmed by increased trading volume and a strong price movement after the crossover. However, it should be used alongside other technical analysis tools.

Can the Golden Cross pattern appear in any stock?

Yes, the Golden Cross pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Golden Cross pattern?

Common mistakes include entering the trade too early before the crossover confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Golden Cross pattern, traders can better anticipate bullish reversals and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Golden Cross pattern in stocks?

Key indicators include the short-term moving average crossing above the long-term moving average, confirming the pattern with increased volume during the crossover, and observing bullish price movements after the crossover. These indicators help validate the Golden Cross pattern and provide insights for potential significant price movements.