Double Top Technical Pattern

Learn about the Double Top pattern in stock trading - a bearish reversal pattern that signals potential downward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Double Top Patterns

15 patterns found

The Gabelli Multimedia Trust Inc

US

Market Cap: 150.16M

Industry: Asset Management

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Washington Trust Bancorp Inc

US

Market Cap: 553.73M

Industry: Banks - Regional

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Invesco Trust For Inv Grade NY Munis

US

Market Cap: 171.00M

Industry: Asset Management

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Grupo Televisa SAB

MX

Market Cap: 1.43B

Industry: Telecom Services

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

OPAL Fuels Inc

US

Market Cap: 76.26M

Industry: Utilities - Regulated Gas

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

NexPoint Strategic Opportunities Fund

US

Market Cap: 138.73M

Industry: REIT - Diversified

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

WESTERN ALLIANCE

US

Market Cap: 9.62B

Industry: Banks - Regional

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

NH3 CLEAN ENERGY LIMITED

AU

Market Cap: 37.55M

Industry: Other Industrial Metals & Mining

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Heartland Express Inc

US

Market Cap: 726.62M

Industry: Trucking

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

CVB Financial Corp

US

Market Cap: 2.67B

Industry: Banks - Regional

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

NEXTNRG INC

US

Market Cap: 171.97M

Industry: Utilities - Renewable

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Independent Bank Corp.

US

Market Cap: 3.47B

Industry: Banks - Regional

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Northwest Bancshares Inc

US

Market Cap: 1.78B

Industry: Banks - Regional

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Rush Enterprises Inc

US

Market Cap: 4.23B

Industry: Auto & Truck Dealerships

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

424960

KR

Market Cap: 90.58M

Industry: Scientific & Technical Instruments

Double Top

12/11/2025

Bearish reversal pattern showing two consecutive peaks at a resistance level, indicating a potential downtrend

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Double Top Patterns

Double Top patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

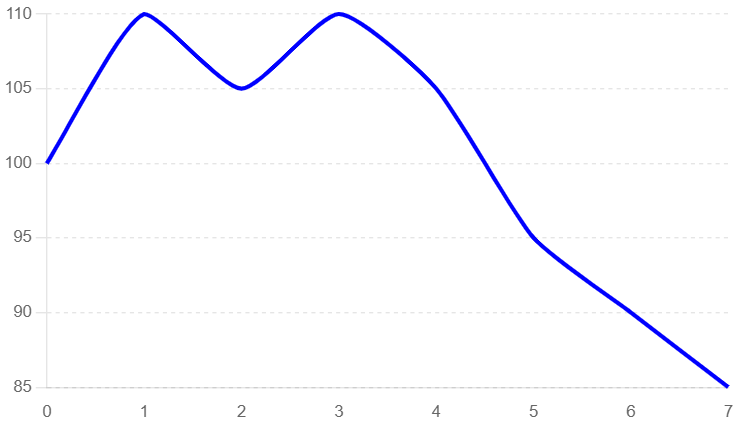

Understanding the Double Top in Stocks

What is the Double Top Pattern in Stocks?

The Double Top pattern is a bearish reversal pattern that appears at the end of an uptrend, indicating a potential downward movement. This pattern forms when the price of a stock hits a high twice, with a moderate low in between, resembling the letter "M" on a price chart. In stock trading, the Double Top pattern is significant because it often marks the end of a bullish phase and the beginning of a bearish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Double Top Patterns

Identifying the Double Top pattern involves several key steps:

- Initial Uptrend: Look for a clear uptrend where the price reaches new highs.

- First Top: The price hits a high point and then declines to form a moderate low.

- Second Top: The price rises again, hitting a similar high point as the first top.

- Breakout: The price declines and breaks below the moderate low, confirming the pattern.

Identifying a Double Top Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Double Top pattern. Key elements to observe include the initial uptrend, the formation of the first and second tops, and the subsequent breakout.

- Initial Uptrend: The price of the stock shows a clear uptrend, indicating bullish market sentiment.

- First Top: The price hits a high point and then declines to form a moderate low.

- Second Top: The price rises again, hitting a similar high point as the first top.

- Breakout Confirmation: The price declines and breaks below the moderate low, confirming the pattern.

Double Top Pattern

Key Indicators

- Candlestick Patterns: Look for reversal candlestick patterns near the tops.

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong selling interest.

- Resistance Levels: The tops should align with significant resistance levels on the chart.

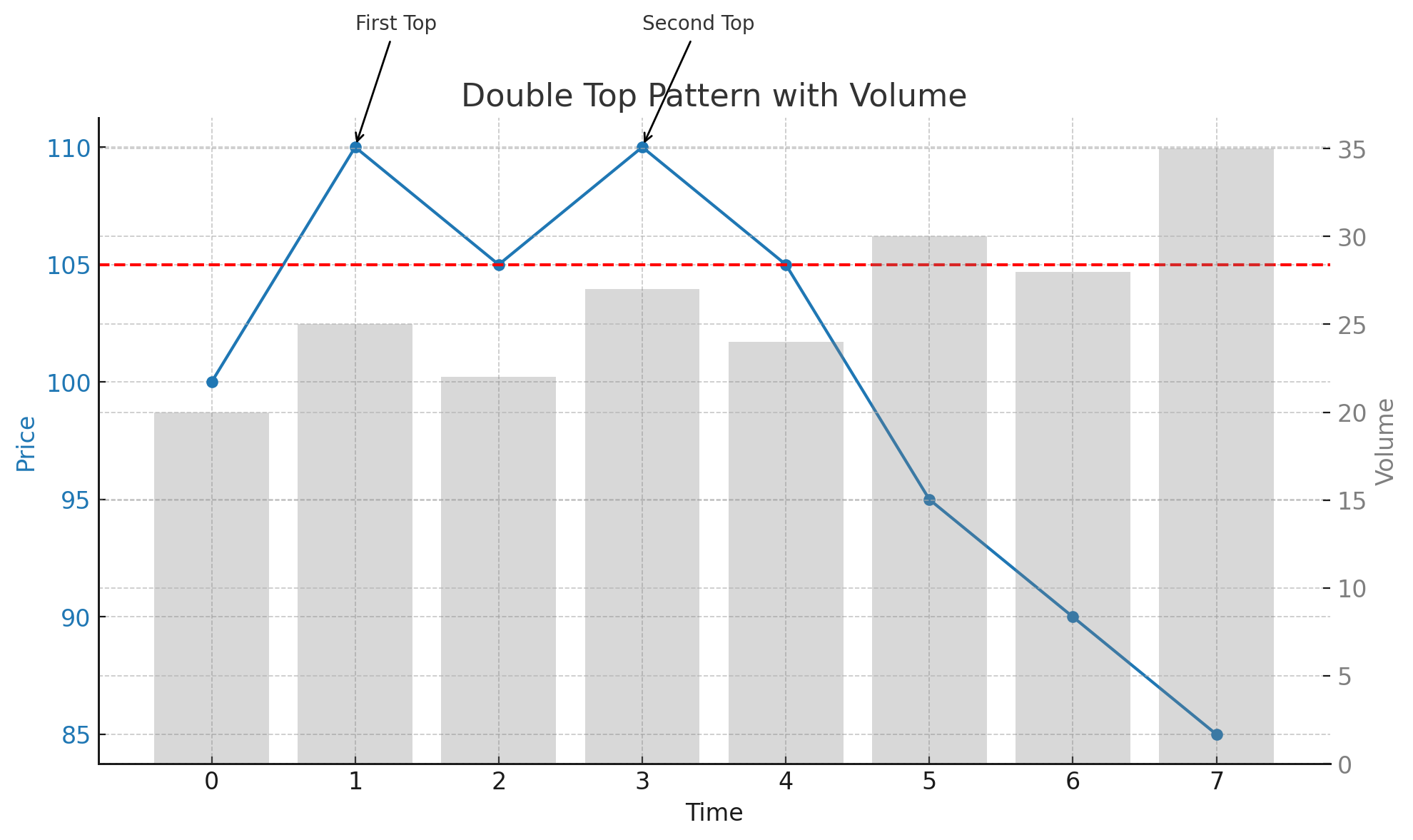

Double Top Pattern with Volume Analysis

This example highlights the role of volume in confirming the Double Top pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Initial Uptrend: The price trend is upward, characterized by increasing prices and moderate volume.

- First Top: The price hits a high point with moderate volume as sellers begin to enter the market.

- Second Top: The price rises again, hitting a similar high point as the first top with moderate volume.

- Breakout: The price declines and breaks below the moderate low with a significant spike in volume, confirming the pattern.

Double Top Pattern with Volume

Frequently Asked Questions

What is the Double Top pattern in stock trading?

The Double Top pattern in stock trading is a bearish reversal pattern that appears at the end of an uptrend. It indicates a potential downward movement and is characterized by the price hitting a high point twice with a moderate low in between, resembling the letter "M."

How reliable is the Double Top pattern in stocks?

The Double Top pattern is considered a reliable bearish reversal signal in stock trading, especially when confirmed by increased trading volume and a strong breakout below the moderate low. However, it should be used alongside other technical analysis tools.

Can the Double Top pattern appear in any stock?

Yes, the Double Top pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Double Top pattern?

Common mistakes include entering the trade too early before the breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Double Top pattern, traders can better anticipate bearish reversals and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Double Top pattern in stocks?

Key indicators include identifying significant resistance levels, confirming the pattern with increased volume during the breakout, and observing reversal candlestick patterns near the tops. These indicators help validate the Double Top pattern and provide insights for potential significant price movements.