Ascending Triangle BreakDown Technical Pattern

Learn about the Triangle Bearish Breakout pattern in stock trading - a continuation pattern that signals potential downward movement. Understand how to identify and trade this technical analysis pattern effectively with volume analysis and key indicators.

Recent Ascending Triangle BreakDown Patterns

15 patterns found

Pinnacle West Capital Corp

US

Market Cap: 10.55B

Industry: Utilities - Regulated Electric

Ascending Triangle BreakDown

12/9/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

SERSTECH AB

SE

Market Cap: 17.29M

Industry: Chemicals

Ascending Triangle BreakDown

12/4/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Haleon PLC

GB

Market Cap: 43.88B

Industry: Drug Manufacturers - Specialty & Generic

Ascending Triangle BreakDown

12/4/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Crossject

FR

Market Cap: 142.98M

Industry: Medical Instruments & Supplies

Ascending Triangle BreakDown

12/1/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

TRANSGENE

FR

Market Cap: 208.85M

Industry: Biotechnology

Ascending Triangle BreakDown

11/27/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

AC Immune Ltd

CH

Market Cap: 300.79M

Industry: Biotechnology

Ascending Triangle BreakDown

11/25/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Algonquin Power Utilities Corp

CA

Market Cap: 19.85B

Ascending Triangle BreakDown

11/25/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Precigen Inc

US

Market Cap: 1.37B

Industry: Biotechnology

Ascending Triangle BreakDown

11/24/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Cementos Pacasmayo SAA

PE

Market Cap: 622.47M

Industry: Building Materials

Ascending Triangle BreakDown

11/21/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Douglas AG

DE

Market Cap: 1.53B

Industry: Specialty Retail

Ascending Triangle BreakDown

11/20/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Sapiens International Corporation N.V.

IL

Market Cap: 2.41B

Industry: Software - Application

Ascending Triangle BreakDown

11/20/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Carver Bancorp Inc

US

Market Cap: 16.79M

Industry: Banks - Regional

Ascending Triangle BreakDown

11/19/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Eaton Vance Municipal Income Trust

US

Market Cap: 412.14M

Industry: Asset Management

Ascending Triangle BreakDown

11/18/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Guggenheim Taxable Municipal Managed Duration Trust

US

Market Cap: 405.19M

Industry: Asset Management

Ascending Triangle BreakDown

11/18/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Provident Financial Holdings Inc

US

Market Cap: 102.20M

Industry: Banks - Regional

Ascending Triangle BreakDown

11/18/2025

Bearish pattern with converging downward trendlines, often leading to a downward breakout

Want to see more technical patterns?

Access our full platform with advanced filtering, real-time alerts, and comprehensive market analysis.

View Full Platform →About Ascending Triangle BreakDown Patterns

Ascending Triangle BreakDown patterns are technical chart formations that traders and investors use to identify potential entry and exit points. These patterns are based on historical price movements and can help predict future price direction.

Understanding the Triangle Bearish Breakout in Stocks

What is the Triangle Bearish Breakout Pattern in Stocks?

The Triangle Bearish Breakout pattern is a continuation pattern that appears during a downtrend, indicating a potential continuation of the downward movement. This pattern forms when the price of a stock consolidates within converging trendlines, creating a triangular shape, before breaking out to the downside. In stock trading, the Triangle Bearish Breakout pattern is significant because it often signals the continuation of a bearish trend. Recognizing this pattern can help traders anticipate price movements and make strategic trades.

How to Identify Triangle Bearish Breakout Patterns

Identifying the Triangle Bearish Breakout pattern involves several key steps:

- Downtrend: Look for a clear downtrend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout: The price breaks below the lower trendline, confirming the pattern.

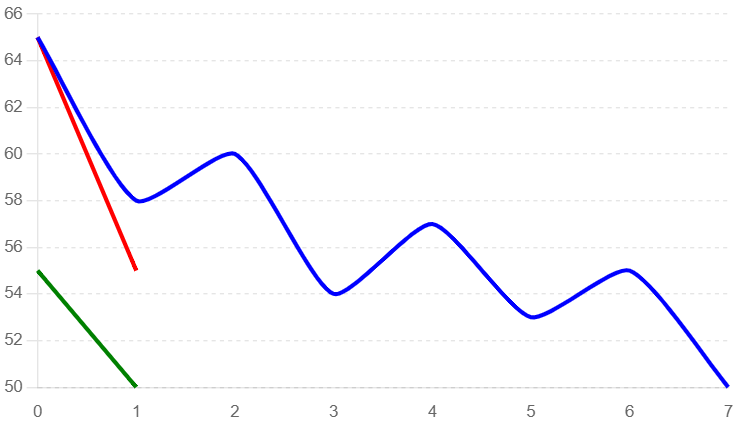

Identifying a Triangle Bearish Breakout Pattern

In this example, we use a typical candlestick chart to illustrate the formation of a Triangle Bearish Breakout pattern. Key elements to observe include the downtrend, the consolidation phase, and the subsequent breakout.

- Downtrend: The price of the stock shows a clear downward trend leading into the pattern.

- Consolidation: The price consolidates within converging trendlines, forming a triangle.

- Breakout Confirmation: The price breaks below the lower trendline, confirming the pattern.

Triangle Bearish Breakout Pattern

Key Indicators

- Volume Spikes: Increased trading volume often accompanies the breakout, indicating strong selling interest.

- Trendlines: Converging trendlines forming the triangle.

- Candlestick Patterns: Look for bearish candlestick patterns near the breakout point.

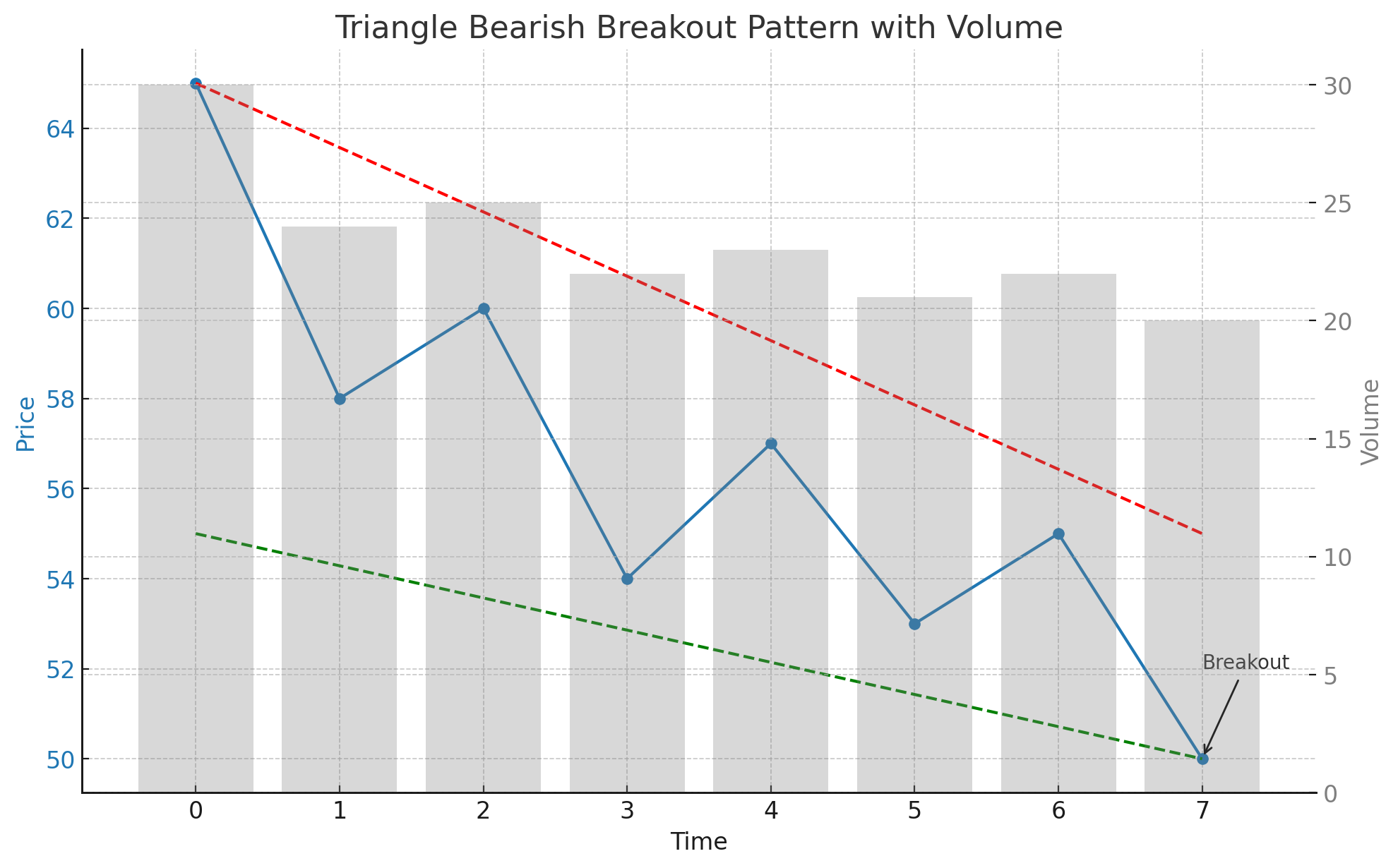

Triangle Bearish Breakout Pattern with Volume Analysis

This example highlights the role of volume in confirming the Triangle Bearish Breakout pattern. Volume analysis can provide additional confidence in the pattern's validity.

- Downtrend: The price trend is downward, characterized by decreasing prices and moderate volume.

- Consolidation: The price consolidates within converging trendlines with moderate volume.

- Breakout: The price breaks below the lower trendline with a significant spike in volume, confirming the pattern.

Triangle Bearish Breakout Pattern with Volume

Frequently Asked Questions

What is the Triangle Bearish Breakout pattern in stock trading?

The Triangle Bearish Breakout pattern in stock trading is a continuation pattern that appears during a downtrend. It indicates a potential continuation of the downward movement and is characterized by the price consolidating within converging trendlines before breaking out to the downside.

How reliable is the Triangle Bearish Breakout pattern in stocks?

The Triangle Bearish Breakout pattern is considered a reliable bearish continuation signal in stock trading, especially when confirmed by increased trading volume and a strong breakout below the lower trendline. However, it should be used alongside other technical analysis tools.

Can the Triangle Bearish Breakout pattern appear in any stock?

Yes, the Triangle Bearish Breakout pattern can appear in any stock. It is a widely applicable chart pattern used in technical analysis across various assets, including stocks.

What common mistakes should be avoided when trading the Triangle Bearish Breakout pattern?

Common mistakes include entering the trade too early before the breakout confirmation, not confirming the pattern with volume analysis, and failing to set appropriate stop-loss levels to manage risk. By understanding and utilizing the Triangle Bearish Breakout pattern, traders can better anticipate bearish continuations and optimize their trading strategies for improved outcomes in the stock market.

What are the key indicators to consider when trading the Triangle Bearish Breakout pattern in stocks?

Key indicators include identifying significant trendlines, confirming the pattern with increased volume during the breakout, and observing bearish candlestick patterns near the breakout point. These indicators help validate the Triangle Bearish Breakout pattern and provide insights for potential significant price movements.